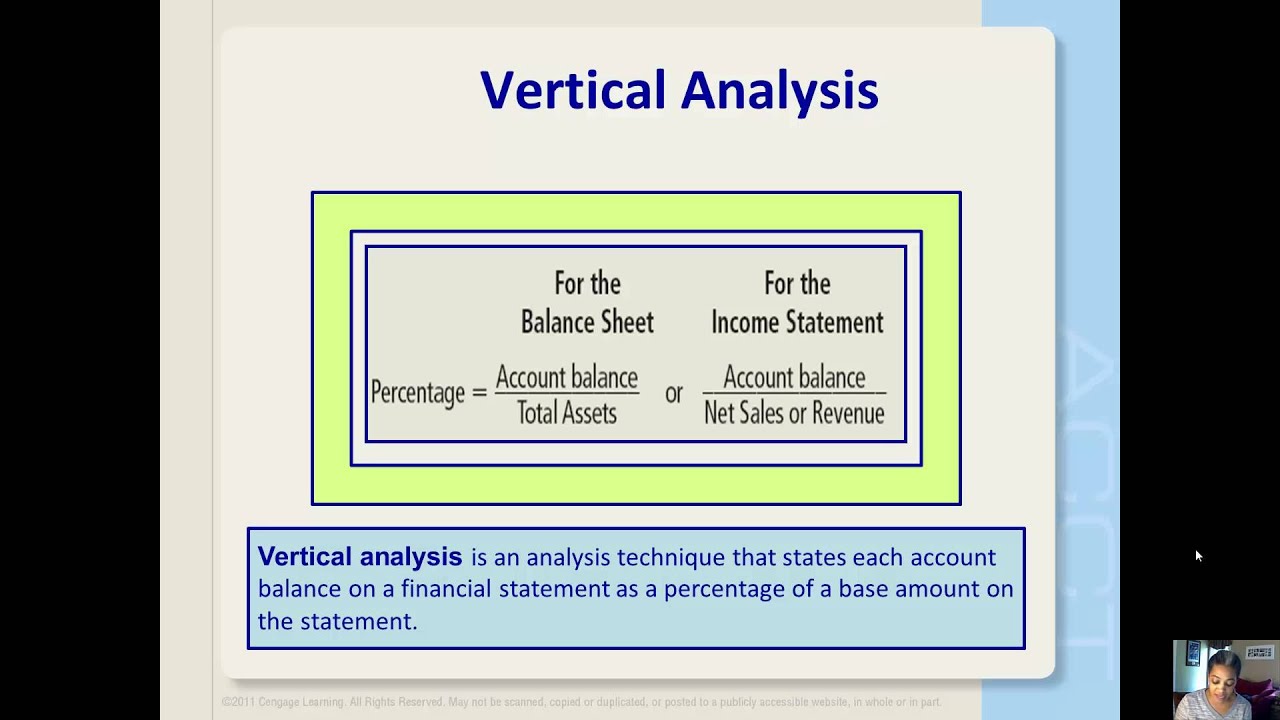

If owner’s equity is $240,000 it will be shown as 60% ($240,000 divided by $400,000). The vertical analysis of the balance sheet will result in a common-size balance sheet. The percentages on a common-size balance sheet allow you to compare a small company’s balance sheets to that of a very large company’s balance sheet. A common-size balance sheet can also be compared to the average percentages for the industry. Horizontal analysis looks at trends over time by comparing numbers across previous periods.

How Can Vertical and Horizontal Analysis Help Individuals Make Better Financial Decisions?

This creates common-size financial statements, where every line item represents a percentage share relative to the whole. To perform horizontal analysis, comparative financial statements are needed for the periods selected. Typically, an income statement and balance sheet is gathered for each period to analyze both profitability and financial position trends. For accurate calculations, the statements must contain the same line items over each period.

Horizontal vs Vertical Analysis: Difference and Comparison

Additionally, it may not provide insights into the absolute values or the impact of external factors. Therefore, vertical analysis is often used in conjunction with other analytical tools to gain a comprehensive understanding of financial performance. One of the pros of vertical analysis is that it allows for the comparison of financial statements from one accounting period to the next as well as for comparisons among different companies. One of its cons is that it doesn’t take into consideration absolute numbers; so if you are comparing two companies, looking at percentages will give a different result than absolute numbers. Vertical analysis enables financial statement comparisons by converting amounts to percentages of a key benchmark metric.

Up, Down, and All Around, Financial Analysis Helps Your Company Succeed

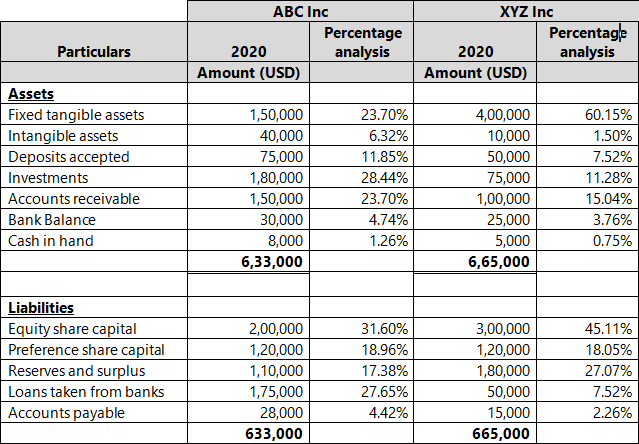

On the other hand, ABC Inc has high dependency on loans for funds raising as compared to XYZ Inc who has a lower percentage of loans vis-à-vis equity. Vertical analysis also allows for the identification of trends within specific line items. By comparing the percentage composition of different periods, businesses can assess changes in the relative importance of various components. For instance, if the percentage of research and development expenses has been consistently increasing over the years, it may indicate a company’s focus on innovation and future growth.

Comparison

For example, by comparing revenue growth over the past five years, a company may identify a consistent upward trend, indicating a healthy business trajectory. Conversely, if expenses have been steadily increasing while revenues remain stagnant, it may signal potential inefficiencies or cost management issues. Horizontal and vertical analysis are two important techniques used to evaluate financial statements over time and relative to industry benchmarks.

Advantages of Horizontal Analysis

- By comparing financial performance with similar organizations, businesses can gain insights into their relative position and identify areas for improvement.

- The 2 million increase in turnover is a positive indication in terms of performance with a 50% increase from the year 2014.

- The more periods you have to compare, the more robust your data set will be, and the more useful the insights gathered.

- A business will look at one period (usually a year) and compare it to another period.

In this article, we will examine all the features of horizontal vs vertical scaling, from how each functions to their respective merits and limitations and real-world use cases. By breaking down the advantages and drawbacks of each, this article will help you better decide which scaling strategy might suit your business. The findings of common size analysis as compiled in the preliminary stages of due diligence are critical. Horizontal analysis indicates long-term trends and highlights areas of strength and those that need improvement. Vertical analysis indicates the relative importance of each line item in a certain period.

In the final section, we’ll perform a horizontal analysis on our company’s historical balance sheet. In other words, vertical analysis can technically be completed with one column of data, but performing horizontal analysis is not practical unless there is enough historical data to have a useful point of reference. For example, if a company’s current year (2022) revenue is $50 million in 2022 and its revenue in the base period, 2021, was $40 million, the net difference between the two periods is $10 million. Consistent margins could indicate stability, while decreasing ratios may signal financial pressures. Horizontal analysis is the comparison of historical financial information over a series of reporting periods.

These percentages are considered common-size because they make businesses within industry comparable by taking out fluctuations for size. It is typical for an income statement to use revenue (or sales) as the comparison line item. difference between horizontal and vertical analysis This means revenue will be set at 100% and all other line items within the income statement will represent a percentage of revenue. Furthermore, horizontal analysis enables benchmarking against industry standards or competitors.